Naushad’s opinion column in Business Standard: Innovation needs the right firms

Innovation needs the right firms

The RDI scheme should fund firms with adequate absorptive capacity—but which firms and how will be key

The Research, Development and Innovation (RDI) scheme has been cleared by the cabinet. The scheme allocates ~ Rs1 trillion (or $12 billion) to funding R&D in Indian industry. Of this, ~ Rs 20,000 Cr is in this year’s budget. Initial comments on how the funds will flow suggest that much of it will be provided in the form of low or zero interest loans to a mix of Funds of Funds and directly to firms. My eyes glaze over in incomprehension when I hear the phrase “Fund of Funds” – I just do not know how they will be held accountable for directly enhancing innovation. I would argue for the bulk of the funding going directly to firms. Why to firms? Which firms? How should they be funded?

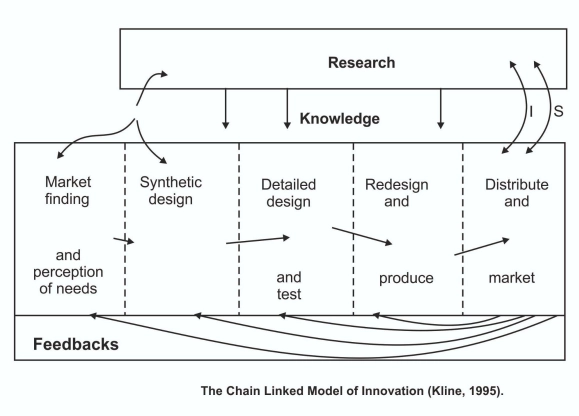

Why fund firms: Innovation happens in firms. There are nuances to that statement, but the fact remains. Get everything else right – publicly funded research done perfectly in higher education, the right national missions, the speedy and unbureaucratic flow of abundant funding – and get what happens in firms wrong and the entire effort will come to nought. I cannot emphasise this enough: innovation, everywhere in the world, largely happens in firms. Consider the now classic Kline chain-linked model of innovation (see figure).

The central innovation activities – market finding, design, and distribution – are all in firms. Research and new knowledge can be invaluable, but they are an input to the innovation system, not its heart. Getting firms to invest more in R&D, to translate that R&D into innovative products and services, and to build businesses around proprietary technology that is deployed internationally is the key to a vibrant national innovation system. So firms must be the focus of any scheme that seeks to enhance innovation. The right R&D pipeline in firms will act as a pull on the public research system like no other. It is inadequate investment in innovation and R&D by Indian industry that is the single factor hindering our national innovation system. That is what RDI must target, and it is best done directly and without intermediaries like Funds of Funds.

Which firms to fund is about Absorptive Capacity: Start with the facts. As I have long argued in this column, in my book and to anyone I can capture for more than two minutes, Indian industry invests too little in R&D. We invest 0.3 per cent of GDP in inhouse R&D to a world average of 1.5 per cent. Our ten most successful non-financial firms (highly profitable firms in refining, IT services and consumer goods) invest 2 percent of profit in R&D; whereas their ten most successful peers in the US, China, Japan and Germany invest between 29 and 55 percent. And Indian firms are

completely missing in five of the ten most technology-intensive industrial sectors worldwide.

The net effect is that the great bulk of Indian industry does not do enough R&D to immediately absorb any substantive increase in funding. Budget’s allocation of ~Rs 20,000 Cr is a decent sum. R&D spending is largely about people – equipment and materials, on average, are less than a third of total spending. An outlay of ~Rs 20,000 Cr could add around 20,000 more people in R&D. Which firms, between them, would be able to expand at scale in one year? We need a set of firms that already invest a large amount in R&D and employ R&D teams of international strength. The firms we pick should be those which are already reasonably R&D intensive— at, say, half the R&D intensity (R&D as a percent of sales) of their international peers. This data is easily available for the top 2500 firms in the world and for us; the table shows our top five firms in the six sectors — pharmaceuticals, chemicals, autos, defence, industrial engineering and food — on average have an R&D intensity that is above half of global levels. The top few R&D investing firms in these six sectors should have the highest absorptive capacity to rapidly expand their R&D teams.

Table 1: Comparison of Top 10 Indian R&D Sectors’ Average R&D Intensity with Respective Global Averages (2023)

| Sector | Indian Average R&D Intensity (Top 5 Firms, %) | Global Average R&D Intensity (%) |

|---|---|---|

| Pharmaceuticals & Biotechnology | 9.4 | 16.2 |

| Automobiles & Parts | 2.3 | 4.7 |

| Oil & Gas | 0.2 | 0.3 |

| Software & Computer Services | 1 | 14.5 |

Aerospace & Defence 6.9 4.4

| Sector | Indian Average R&D Intensity (Top 5 Firms, %) | Global Average R&D Intensity (%) |

|---|---|---|

| Chemicals | 1.7 | 2.2 |

| Industrial Engineering | 2.2 | 3.2 |

| Industrial Metals & Mining | 0.3 | 1.6 |

| Electronic & Electrical Equipment | 0.9 | 5.1 |

| Food Producers | 1.5 | 1.2 |

Source: CTIER Handbook: Technology and Innovation in India 2025 (forthcoming)

How we should fund firms: Competition begets quality, so a generous direct funding scheme should seek to attract many more applications than there are funds available. Get applications from many of the top, say, 300 Indian R&D investors. Our hundredth largest spending firm invested Rs 97 Cr in R&D in 2022-23 , our two-hundredth largest Rs 33 Cr and three-hundredth largest Rs 16 Cr. These are small numbers relative to the world’s leading firms. The RDI scheme should directly aim to change this. I would suggest that we require the firms we fund by RDI to expand R&D in terms of the number of people employed in R&D by one-half in the next twelve months. Successfully doing so could lead to another similar tranche of funding, and so on. (Conversely, expanding by under one-third should result in the firm dropping out in the next round.) In five years, the consistently successful firms should be investing eight times as much in in-house R&D – enough to show in India’s aggregate R&D statistics and to build a solid R&D pipeline of new products and services that begin to flow out into the world.

We should have a second requirement. Firms that get funded by RDI should deepen the R&D they do. “Deepen” means they should be investing in lower Technology Readiness Levels. In the jargon of the field, where TRL 7 – 9 is the development that firms typically do and TRL 1 – 3 the best research done in academia, firms should

begin to “pull” in publicly funded research to deepen their innovation effort. That would mean investing in the TRL 4 – 6 space where research findings move onto proof of concepts that then start translating into products and services that are commercially viable. We do also need transparent metrics to objectively assess TRLs, keeping our goal of deepening the R&D we do constantly in focus.

What good looks like: We today have no firms that match their world leading peers in both the percentage of turnover and absolute amount invested in R&D. Five years out, we should expect over 100 Indian firms that do so. These firms will, in turn, act as role models for many others, and we will be on our way to a vibrant, world-leading national innovation system.

Naushad Forbes

ndforbes@forbesmarshall.com

Co-Chairman Forbes Marshall, Founding member of Nayanta University, Past President CII, Chairman of Centre for Technology Innovation and Economic Research. His book, The Struggle and the Promise has been published by HarperCollins.

(Published in Business Standard dated 17th July 2025)